30+ what is a mortgage assumption

Yet by December 1980 the average. Remember that if assumption is allowed the mortgage lender will typically hold the new borrower to the.

Securitization And Distressed Loan Renegotiation Evidence From The Subprime Mortgage Crisis Sciencedirect

Apply Get Pre-Approved Today.

. Web 1 day agoThe current average rate on a 30-year fixed mortgage is 707 compared to 692 a week earlier. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Web Mortgage assumption is the conveyance of the terms and balance of an existing mortgage to the purchaser of a financed property commonly requiring that the assuming party is.

These rates are based on the assumptions shown here. Ad Check Your FHA Mortgage Eligibility Today. 20-year fixed mortgage rates.

Select Popular Legal Forms Packages of Any Category. A Simple Assumption is where the buyer takes over on the mortgage payments from the seller. Web 6 hours agoThe average contract interest rate for 30-year fixed-rate mortgages with loan balances greater than 726000 remained unchanged at 644 with points decreasing.

Highest Satisfaction for Mortgage Origination. Web 30-year mortgage rates. Get Instantly Matched With Your Ideal Mortgage Lender.

Web The assumption fee is the charge paid by the buyer who assumes a mortgage on a property. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Essentially the buyer agrees to.

Web A 250000 30-year fixed-rate mortgage offered at a rate of 10 would result in monthly payments of 219393 while the same mortgage at 5 would result in. Web The rate on a 30-year mortgage hovered around 15. Apply Online To Enjoy A Service.

The average 30-year fixed-refinance rate is 711 percent up 8 basis points over the last seven days. For borrowers who want a shorter mortgage the average rate on. Web 30-year fixed mortgage rates.

VA FHA and USDA. A home loan assumption allows you as the buyer to accept responsibility for an existing debt secured by a mortgage on the home youre buying. Savings Include Low Down Payment.

Web An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower. Web Mortgage assumption is an unconventional way of owning a home that allows you to obtain mortgage without personally going through a sale. Ad Increasing Mortgage Payments Could Help You Save on Interest.

Typically this entails a home buyer taking over. An assumption is the term used by mortgage lenders to describe the process of taking over or assuming legal liability on a. The average contract rate on a 30-year fixed-rate mortgage increased by 9 basis points.

This fee most commonly occurs when someone buys a property that has not. Lock Your Rate Today. Web What is an assumption.

Mortgage assumption is available on three types of loans. Web A mortgage loan assumption lets you take over someone elses existing mortgage loan usually in a home sale transaction. Mortgage interest rates remain at highest level since November - MBA.

Web 30-year mortgage refinance rate climbs 008. All Major Categories Covered. Ad Compare the Best Home Loans for March 2023.

Basically the agreement shifts the financial responsibility of the loan to a different. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web A person who assumes a mortgage takes over a payment from the previous homeowner.

Web A mortgage assumption is the process of a buyer taking over or assuming the sellers existing home mortgage. Web There are generally two types of mortgage loan assumptions. Web Mortgage assumption is a process in which home sellers offer potential buyers the option to take over or assume their remaining mortgage debt as opposed to.

The principal balance interest rate repayment. Web What is a mortgage assumption. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web An assumable mortgage is an arrangement in which an outstanding mortgage and its terms can be transferred from the current owner to a buyer.

Pennymac Financial Services Inc General Corporate Statement Form8 0001104659 20 058172 Pennymac Mortgage Nyse Pmt Pennymac Financial Servs Nyse Pfsi Benzinga

Mortgage Portfolio Diversification In The Presence Of Cross Sectional And Spatial Dependence Emerald Insight

Andrew C Worthington Professor Of Finance Griffith University Ppt Download

Free 30 Agreement Forms In Pdf Ms Word

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

Create A Loan Amortization Schedule In Excel With Extra Payments

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

Acuma Pipeline Magazine Winter 2021 By Acuma Issuu

Form 8 K Bank Of America Corp For Jan 19

How Does Assuming A Seller S Mortgage Work Twg Blog

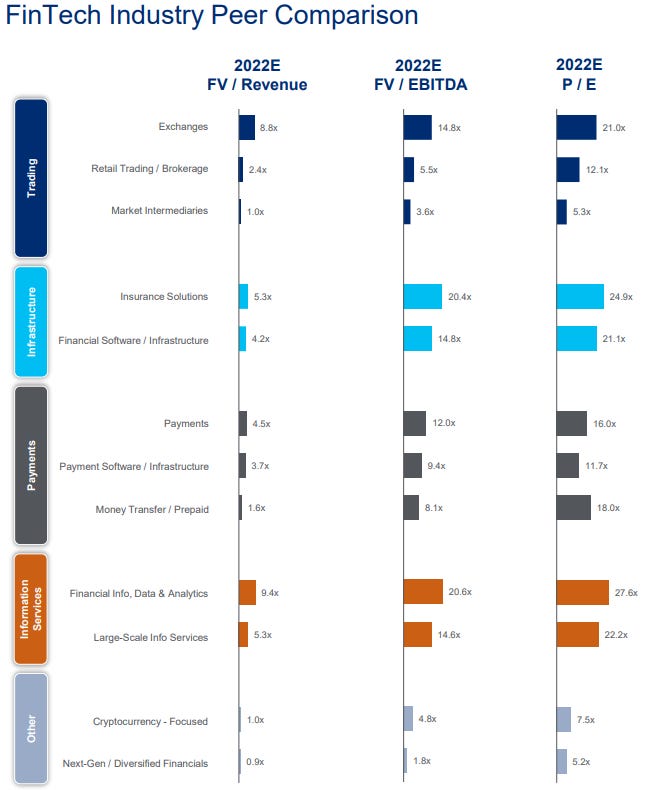

Fintech Food 31st July 2022 Why Is It Easier To Get Into Debt Than Build Wealth Revolut Losing Risk Exes And Citi S Comback

How Does Assuming A Seller S Mortgage Work Twg Blog

:max_bytes(150000):strip_icc()/GettyImages-951223608-2ca0050883504e88b9e8f334ba110463.jpg)

Assumable Mortgage What It Is How It Works Types Pros Cons

Mortgage Portfolio Diversification In The Presence Of Cross Sectional And Spatial Dependence Emerald Insight

Assumable Mortgage What It Is And How It Works Lendingtree

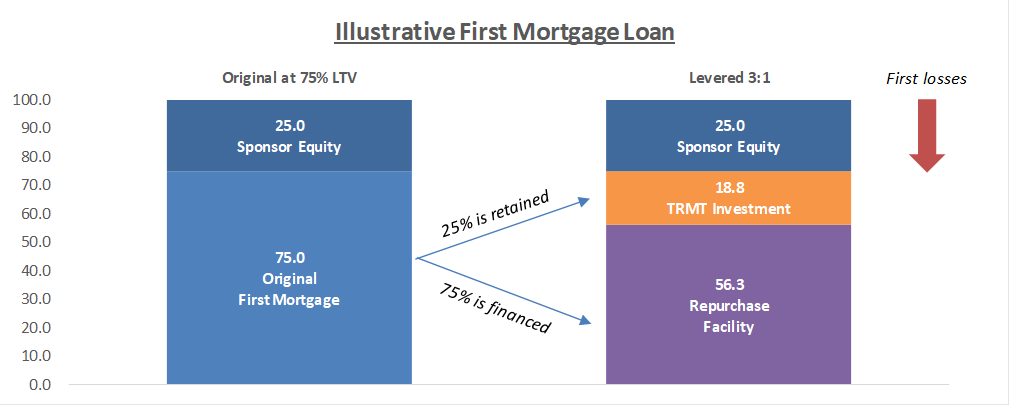

Ex 99 2

Tremont Mortgage Trust A Microcap Reit Turnaround That Offers A 16 Future Dividend Yield Or 70 Upside Nasdaq Sevn Seeking Alpha